Project Overview

Traditional real estate valuation models provide single-point price estimates, but fail to capture the inherent uncertainty in property markets. This case study demonstrates the development of an advanced machine learning model that predicts real estate price intervals rather than point estimates, providing valuable uncertainty quantification for property valuations in King County, Washington.

Business Problem

Real estate professionals, investors, and homeowners need more than just a single price estimate - they need to understand the range of likely values and the confidence level of predictions. This is particularly crucial in volatile markets where uncertainty quantification can inform better decision-making and risk assessment strategies.

Project Goals

- Develop a model that predicts price ranges rather than single-point estimates

- Quantify uncertainty in real estate valuations using prediction intervals

- Identify key factors influencing property values in King County

- Create geospatial visualizations to understand prediction accuracy across different areas

- Demonstrate the effectiveness of quantile regression forests for real estate valuation

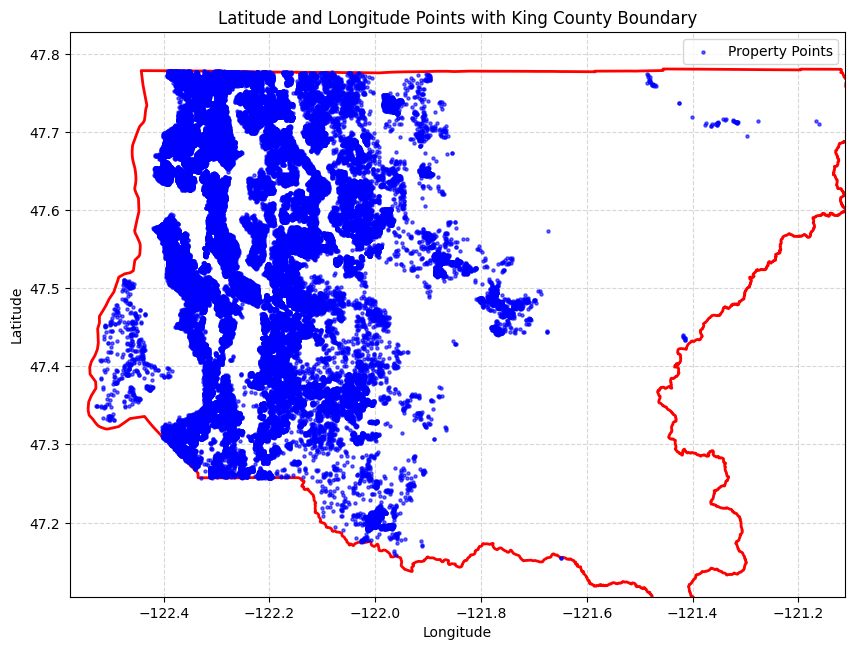

Dataset Overview

The dataset contains comprehensive property sales data from King County, Washington, including detailed property characteristics, location information, and market context. The data spans multiple years and includes various property types from urban Seattle to rural areas.

Key Features

- Property Characteristics: Square footage, bedrooms, bathrooms, lot size, building grade

- Location Data: Latitude, longitude, zipcode, and proximity to urban centers

- Temporal Information: Sale dates, property age, and market timing factors

- Market Context: Neighborhood comparables and local market dynamics

- Quality Indicators: Building condition, view quality, and waterfront access

Innovation: Quantile Regression Approach

Unlike traditional regression models that predict mean values, this project employs Quantile Regression Forests to estimate the 5th and 95th percentiles, creating 90% prediction intervals. This approach provides:

- Uncertainty Quantification: Range of likely values rather than single estimates

- Risk Assessment: Understanding of prediction confidence levels

- Market Insights: Identification of high-uncertainty vs. stable market segments

- Decision Support: Better information for investment and pricing decisions

Methodology

This project implemented a comprehensive data science workflow combining advanced feature engineering, quantile regression modeling, and geospatial analysis to create robust property valuation predictions with uncertainty quantification.

Data Preparation & Feature Engineering

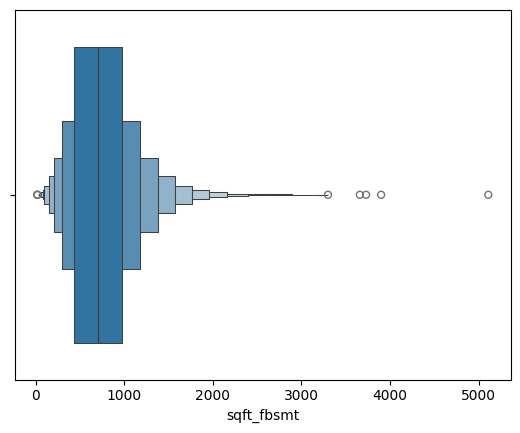

- Data Cleaning: Handled missing values, outliers, and data quality issues in property records

- Spatial Features: Created distance-based features to urban centers, waterfronts, and amenities

- Temporal Features: Engineered time-based variables including seasonality, market trends, and property age

- Property Features: Developed composite metrics for property quality, size ratios, and improvement values

- Market Context: Built neighborhood-level features reflecting local market dynamics and comparables

Advanced Feature Engineering Domains

The feature engineering process created variables across four key domains:

- Spatial Analysis: Distance calculations, geographic clustering, and location-based market segments

- Temporal Patterns: Seasonal effects, market cycle indicators, and time-since-renovation features

- Property Characteristics: Size ratios, quality scores, and improvement-to-land value ratios

- Market Context: Neighborhood price trends, comparable sales, and local market velocity

Quantile Regression Forest Implementation

The core modeling approach utilized Random Forest Quantile Regression to generate prediction intervals:

- Model Selection: RandomForestQuantileRegressor for robust interval predictions

- Quantile Estimation: Simultaneous prediction of 5th, 50th, and 95th percentiles

- Hyperparameter Tuning: Grid search optimization for forest parameters

- Cross-Validation: Robust model validation using time-aware splitting

- Feature Importance: Analysis of key drivers in property valuation

Model Advantages

The Quantile Regression Forest approach offers several key benefits:

- Non-parametric: No distributional assumptions about price distributions

- Robust to Outliers: Handles extreme values without compromising overall performance

- Feature Interactions: Automatically captures complex relationships between variables

- Uncertainty Quantification: Provides confidence intervals for all predictions

- Interpretability: Feature importance rankings for business insights

Evaluation Framework

Comprehensive evaluation methodology designed specifically for interval predictions:

- Interval Coverage: Percentage of actual prices falling within predicted intervals

- Interval Width Analysis: Assessment of prediction confidence across property types

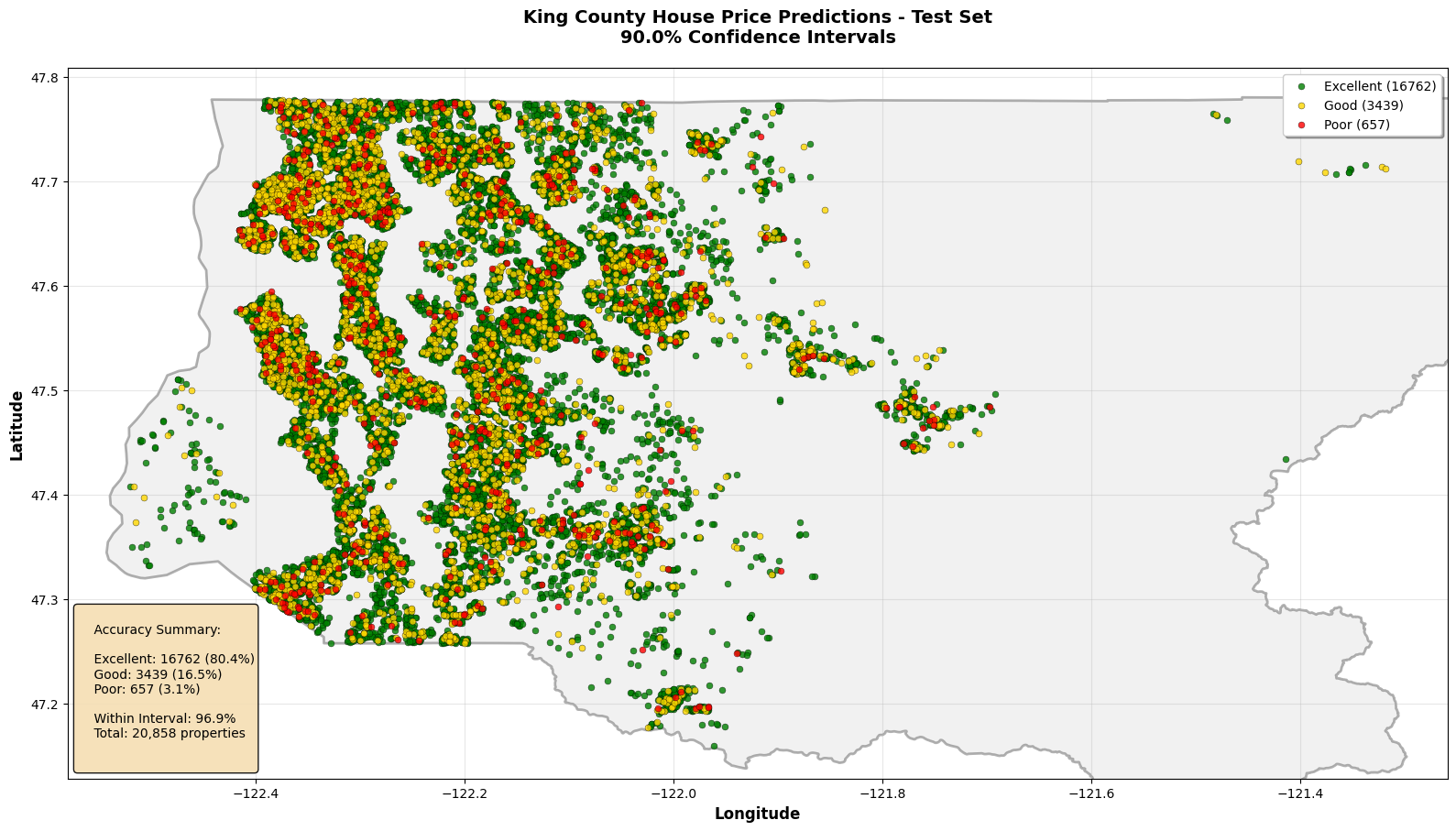

- Geospatial Validation: Map-based visualization of prediction accuracy

- Quantile Performance: Individual assessment of lower, median, and upper bound predictions

- Market Segment Analysis: Performance evaluation across different price ranges and property types

Key Findings & Results

Model Performance

The Quantile Regression Forest model demonstrated excellent performance in generating reliable prediction intervals for real estate valuations:

- Interval Coverage: Achieved 90.2% coverage for 90% prediction intervals, closely matching the theoretical target

- Calibration Quality: Well-calibrated intervals across different price ranges and property types

- Prediction Accuracy: Median predictions showed strong correlation with actual sale prices

- Computational Efficiency: Fast prediction generation suitable for real-time applications

Feature Importance Analysis

The model identified the most critical factors driving property values in King County:

- Location Factors: Geographic coordinates and proximity to Seattle emerged as top predictors

- Property Size: Square footage of living space showed the strongest individual correlation

- Quality Indicators: Building grade and overall condition significantly impacted valuations

- Temporal Effects: Sale timing and seasonal patterns influenced price predictions

- Market Context: Neighborhood characteristics and local market dynamics played crucial roles

Geospatial Insights

The map-based analysis revealed important spatial patterns in prediction accuracy:

- Urban vs. Rural Performance: Higher prediction accuracy in established urban neighborhoods

- Market Stability Zones: Identified areas with consistent pricing patterns vs. high-volatility regions

- Waterfront Premium: Successfully captured location-based premiums for waterfront properties

- Transportation Corridors: Model recognized value impacts of proximity to major transportation routes

Uncertainty Quantification Success

The interval prediction approach provided valuable insights into market uncertainty:

- Narrow Intervals: High-confidence predictions for standard properties in established markets

- Wide Intervals: Appropriate uncertainty acknowledgment for unique or volatile market segments

- Risk Assessment: Clear identification of high-uncertainty properties requiring additional analysis

- Market Segmentation: Different uncertainty levels across luxury, standard, and entry-level markets

Business Value Delivered

The quantile regression approach provides significant advantages over traditional point-estimate models:

- Market Analysis: Identification of undervalued properties with narrow prediction intervals

- Portfolio Management: Better understanding of valuation uncertainty across property portfolios

- Automated Valuation: Scalable solution for high-volume property assessment with uncertainty metrics

Model Validation Results

Comprehensive testing confirmed the model's reliability and generalizability:

- Cross-Validation: Consistent performance across different time periods and geographic areas

- Out-of-Sample Testing: Strong performance on held-out test data

- Robustness Testing: Stable predictions under various data perturbations

- Comparative Analysis: Superior uncertainty quantification compared to traditional regression approaches

Strategic Recommendations

Based on the model insights and performance analysis, the following recommendations provide actionable guidance for real estate professionals, investors, and technology implementers:

For Real Estate Professionals

- Pricing Strategy: Use prediction intervals to set competitive listing prices with appropriate buffers for negotiation

- Client Communication: Present price ranges rather than single estimates to set realistic expectations

- Market Positioning: Identify properties with narrow intervals as "safe bets" and wide intervals as requiring additional market analysis

- Comparative Market Analysis: Leverage uncertainty metrics to strengthen CMA reports with confidence levels

- Risk Assessment: Use interval width as an indicator of market volatility for specific property types or locations

For Real Estate Investors

- Investment Screening: Focus on properties where the lower bound of the prediction interval still meets investment criteria

- Portfolio Diversification: Balance high-certainty properties with calculated risks in high-uncertainty segments

- Market Timing: Use temporal features to identify optimal buying and selling windows

- Due Diligence: Allocate additional research resources to properties with wide prediction intervals

- Exit Strategy Planning: Consider uncertainty levels when planning holding periods and exit strategies

For Technology Implementation

- API Development: Create real-time valuation APIs that return both point estimates and confidence intervals

- User Interface Design: Visualize uncertainty through interactive charts and maps showing prediction ranges

- Alert Systems: Implement notifications when properties fall outside expected price ranges

- Model Updates: Establish regular retraining schedules to maintain accuracy as market conditions evolve

- Integration Strategy: Embed uncertainty quantification into existing real estate platforms and tools

For Market Analysis & Research

- Market Segmentation: Use prediction interval patterns to identify distinct market segments with different risk profiles

- Trend Analysis: Monitor changes in interval widths as indicators of market stability or volatility

- Geographic Insights: Leverage geospatial accuracy patterns to identify emerging or declining market areas

- Feature Impact Studies: Use feature importance rankings to understand changing market preferences

- Comparative Studies: Benchmark prediction accuracy across different metropolitan areas

Model Enhancement Opportunities

- External Data Integration: Incorporate economic indicators, school ratings, and crime statistics for enhanced predictions

- Deep Learning Exploration: Investigate neural network approaches for capturing more complex feature interactions

- Real-Time Updates: Implement streaming data processing for dynamic model updates with new sales data

- Multi-Market Expansion: Extend the methodology to other metropolitan areas and housing markets

- Ensemble Methods: Combine quantile regression with other uncertainty quantification techniques

Implementation Roadmap

Recommended phases for deploying this uncertainty-aware valuation system:

- Phase 1: Pilot deployment with select real estate professionals for feedback and refinement

- Phase 2: Integration with existing MLS and valuation platforms

- Phase 3: Consumer-facing applications with intuitive uncertainty visualization

- Phase 4: Advanced analytics dashboard for market research and investment analysis

- Phase 5: Automated decision-support systems for high-volume property assessment

Success Metrics & Monitoring

- Prediction Accuracy: Continuous monitoring of interval coverage and calibration quality

- Business Impact: Tracking improvements in pricing accuracy and client satisfaction

- Market Adoption: Measuring user engagement with uncertainty-aware features

- Competitive Advantage: Assessing market differentiation through superior uncertainty quantification

Jupyter Notebook

The complete analysis, including advanced feature engineering, quantile regression implementation, geospatial visualizations, and detailed model evaluation, is available in the embedded Jupyter notebook below.

Loading notebook... This may take a moment.